Mobile banking app development

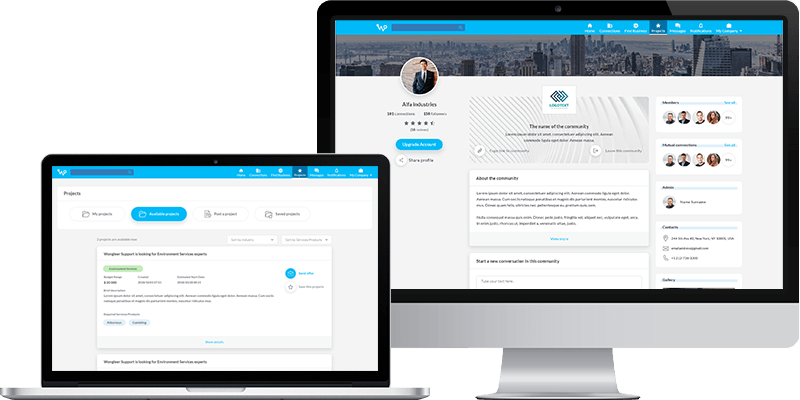

DICEUS is a global technology partner for banks, one of a few dedicated mobile banking app development companies. You can get various solutions, not only the banking app development of iOS and Android products with core mobile banking features. We also optimize legacy systems, upgrade them, add new modules, change applications to make them compliant with central banks’ regulations, design architecture and UI/UX, migrate data, do software audit and business analysis.

You can check a few typical services from our offerings related to banking app development. You can get any requested feature or module added to your digital application. While traditional mobile banking app development companies create similar products for the masses, we praise personalized approach.

Anti-fraud modeling

Mobile apps should be secure. We offer custom anti-fraud tools, reports, monitoring modules, as well as upgrades to meet new rules from central banks.

System architecture

You can get improved modules so your internal experts will be able to add new processes or change existing ones in the shortest time possible.

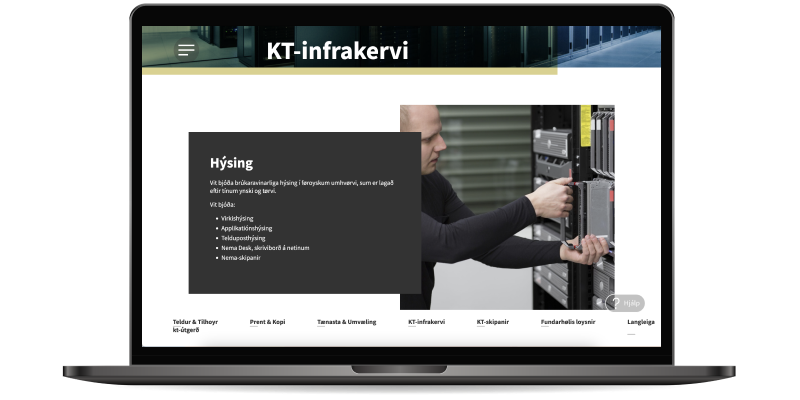

UI design

This service makes the general look and interface of your mobile banking system polished and user-friendly for excellent user experience.

UX design

Apart from UI, we provide UX services. They ensure that your application is understandable and that clients can find everything they need quickly.

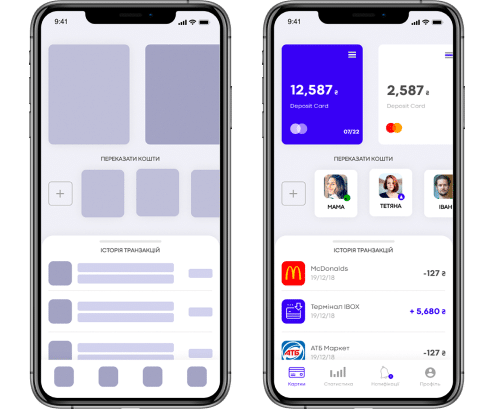

Mobile banking app development is crucial for financial institutions. As customers become more dynamic, they prefer to access core services through apps. Even websites are becoming less demanded because people focus on the smooth native experience. When your clients can check balances, send money, pay bills, or find ATMs in a few clicks, they appreciate your effort. Hence, the mobile banking software is one of the best investments you can make right now.

Mobile banking features

- Registration

- Identification

- Deposit application

- Card application

- Card management

- Loan application

- Loan repayment

- Money transfers

- Money withdrawals

- Payment templates

- Bank communication

- Spending tracking

- Currency exchange

- Money transfers by phone number

- Mobile phone refill

- Payments of utility bills

- Payments for services

- Tax and budget payments

- Invoicing

- Payee verification

- Access for employees

- Salary management

Get a free consultation on your project!

Benefits of mobile banking app development

Let’s be honest: you don’t need a FinTech mobile app in your bank if you don’t want to fight for the customers. And we mean fierce and 24/7 competition with many other market players. That’s why basic mobile banking application development doesn’t work. People want the best of the best.

If you’re ready to get a solution to attract, convert, and retain clients, both SMEs and individuals, just drop us a request. We’ve designed dozens of applications for banks from Europe, the USA, and the Middle East. And we know what people really need:

Our mobile banking development process

With us, you get a reliable and standard-driven approach combined with professional mobile banking app developers. According to the dev lifecycle, we start any project with an initial analysis. This stage helps us to understand your business better to deliver exactly what you need. After requirements gathering and planning, we design, develop, test, and implement the application. Upon request, our mobile banking app developers can change the approach to speed up certain phases or dedicate more time to them.

In both cases, you get your online banking system designed, developed, and updated according to your unique needs. We guarantee that our solutions include all the key functionalities and have an attractive and user-friendly design. Moreover, after deployment, you can add or change features or other modules quickly to introduce new services, adjust existing ones, or comply with regulations. Needless to say that all projects are completed on time, on budget, and on spec.

Actual service delivery processes are standard-based and stable. Traditionally, we start with the business analysis phase to gather your requirements and understand business needs. Further, we design architecture and UI/UX, develop the online banking system itself or upgrade existing modules, test everything, deploy, and support online banking solutions. The flow can be changed upon request, for example, we can speed up everything if you want to launch software faster.

What impacts your project duration

To develop or upgrade any mobile banking software, we need from 6 to 9 months on average. Exact terms vary greatly. You can get a small project with a few updates to your existing app completed much faster than a complex one with custom development from scratch. The more features you need, the longer it takes to develop them, as a rule.

- Project requirements

- Expected deadlines

- Team composition

- Chosen technology and platforms

What affects your project costs

Mobile banking solutions can be different in terms of scope and complexity. Costs can be different, too, respectively. Here are the core factors that affect the total cost:

- Project scope and complexity

- Chosen technology

- Project completion urgency

- Engagement model: Fixed Price, Time and Material, Dedicated Team

- API availability and the number of secure integrations

What we need from your side

As long as the majority of banking processes rely on core banking systems, it’s crucial to prepare your API. Hence, your primary responsibility is to provide access to API integrated with the core banking platform. Furthermore, it’s a good idea to provide at least two team members from your side to ensure knowledge transfers and efficient communication.

- Project goals, vision, and roadmap if exist

- High-level project requirements

- Project-specific documentation if available, for example, a test strategy or test cases

- Client’s availability (a couple of hours per week for requirements gathering sessions)

- Project deadlines

Our tech stack

Explore our case studies

Frequently asked questions

What is a mobile banking application?

It’s a fintech solution designed for mobile devices like smartphones or tablets. Mobile banking app developers create such digital tools to provide banking functions through mobile channels. Via mobile apps, users can interact with the bank, check accounts, transfer money, access other available banking products like deposits, loans, etc.

What are the types of mobile banking?

Apart from banking app development, there are more mobile options that provide access to banking services. These include SMS and USSD connections through which users can receive and send text messages. As well, banks can create mobile-optimized versions of their websites to provide services without dedicated mobile apps.

How do you develop mobile banking apps?

Our mobile banking app developers have experience in modern and innovative technologies and industries. We build various modules, including AI-based services, RPA for banks, advanced data warehouses, etc. Depending on your requirements, we change banking app development processes and suggest the most efficient technologies.