Enterprise mobile application development: A detailed guide

With the global number of mobile devices twice as large as the entire population of the Earth, these gadgets are going to play an ever-increasing role in all industries — from education and healthcare to entertainment and banking. In this article, you will learn why enterprise mobile application development is crucial for every business. Here, you can also explore the key benefits a mobile app could bring to your company, how to build such an app, what features it should have, and other useful information.

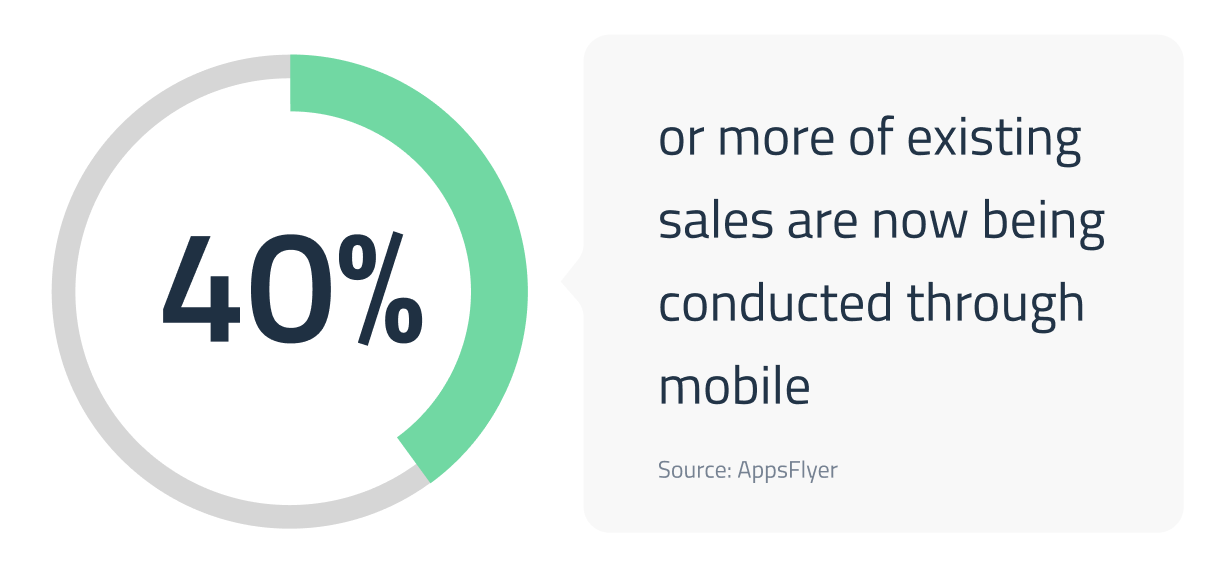

Sensing the direction where the digitalization wind is blowing, decision-makers in different realms emphasize mobile experience in their companies’ workflow. Businesses invest prodigious sums in mobile enterprise app development that takes up about a third of the application development market being the second most popular app type at the Apple app store.

Looking for professional mobile developers? Check out our enterprise mobile application development services.

What is enterprise mobile app development?

Enterprise mobile app development is the custom engineering of a mobile application called to serve specifically for a particular business.

Much like it happens in other domains, enterprise personnel leverages mobile apps to solve work-related tasks. Since the proportion of such employees has reached 60% seven years ago, today, enterprise mobility is likely to involve a much more significant percentage of workers. This trend led many organizations to encourage BYOD (Bring Your Own Device) practices for enhanced efficiency and productivity. Yet, utilizing apps personal gizmos contain to store and process corporate data is rather dubious security-wise, putting their safety under serious tampering threat.

That is why future-oriented and security-aware CEOs opt for enterprise application development, commissioning from seasoned IT companies bespoke apps to meet their business needs. As a rule, such software is cloud to be accessible and integrated with multiple platforms and networks.

An essential boon that a custom enterprise mobile app development company brings is total control over numerous aspects of business workflow. All shopfloor activities and communications are automated and radically streamlined being protected from unauthorized intrusions by tight security measures.

How can enterprise mobile apps help your business?

If your company is doing fine, you may doubt whether you need an enterprise app. However, across-the-board digitalization leaves you with no choice if you want to keep abreast of the latest technologies and don’t relish the idea of lagging behind your competitors. A high-quality app for enterprise will be incredibly instrumental in the following activities:

Monitoring personnel activities

Whatever your employees do, you can track their statuses through the app. They can report on assignments and their completion via the app, which moves the office outside brick-and-mortar buildings and allows taking it with them wherever they go.

Minimizing paperwork

Nowadays, when the majority of data is in digital format, sticking to bulky folders and unwieldy spreadsheets is sure to handicap your routine practices. An enterprise app will enable you to drastically cut down on the number of paper documents circulating within your organization.

Boosting data management

When all your data is already in computer-friendly shape, apps can do a great job in verifying, adjusting, analyzing, and other processing operations, thus augmenting the company’s efficiency tremendously.

Automating minor and repetitive tasks

Human potential is wasted if employees spend much time doing some simple but time-consuming errands. Let the app do it, whereas personnel can focus on more sophisticated or creative tasks.

Automating employee certification

Small tasks can be automated via utilizing apps and more complex endeavors like certification procedures with the information about it handled by the same enterprise software.

Quicker employee onboarding

Thanks to enterprise mobile apps, the work of HR departments can be remarkably streamlined.

Controlling transactions and payments

This feature is relevant for retail ventures, which get payment deadlines and other notifications administered by enterprise mobility solutions.

Optimizing supply chain

With the app geared for such purposes, you can exercise end-to-end control of the supply chain, having all details of planning, delivery, and transportation management at your fingertips.

Enhancing customer support

When clients’ inquiries are funneled through the app, their handling is facilitated and improved. The software automatically deals with fundamental issues, and humans tackle more complex tasks.

All-in-all, introducing an enterprise mobile app in an organization’s workflow spells bolstered business efficiency, increased flexibility, better employee engagement, lower customer churn, and plenty of valuable insights into problem areas that require improvement.

Developing an enterprise app: An algorithm to follow

Being a competent enterprise mobile application development company, DICEUS has devised a simple and efficient strategy consisting of ten development process steps.

Step 1. Research

Any project kicks off with preliminary research called to lay the conceptual foundations of the future product. First, CEOs and managers should determine the problem they want to solve with the app’s help. These consultations clarify business objectives, project scope, and key functionalities. Then, the prospective users of the app are polled to hear their stories and realize the needs and requirements of enterprise employees who will apply the app in their everyday work.

If the customer wants to revamp the existing solution, it is necessary to evaluate it, see its fortes, and gauge the inadequacies that need strengthening or replacement.

The final stage of this phase is a competitive analysis of similar products that pursue comparable goals. It is done to expose their best practices worth borrowing and pinpoint shortcomings that should be avoided in the project that you are launching.

Step 2. Cost estimation

The customer must fathom how deep their pocket is to see what product they can afford. At this stage, you will come up only with a ballpark figure that will be corrected further (sometimes, quite significantly). The final cost will have to be discussed with the vendor after agreeing upon technical and development team composition issues.

Step 3. Tech stack

This is the benchmark dilemma in any app development endeavor. If you aren’t adept at the no-code platform approach, you should select the platform your enterprise app will operate on. Typically, it is Android or iOS. This choice conditions what languages and tools to utilize, and often, what experts to recruit. A possible alternative to iOS or Android app development is a cross-platform product that would function on any gadget type.

If a native app of either kind is too expensive for you, try a Progressive Web App (PWA). This is a website by nature that, falling short of native security and feature roster, outstrips native apps in performance, flexibility, and offline functioning potential. The choice of the platform determines the technical nitty-gritty of the next stage.

Step 4. Specifications

Here, you determine the system’s architecture and engineering charter of the enterprise app. The other technical requirements may include API documentation, third-party services, dependencies, environments, frameworks, etc. You also get a detailed roadmap of feature development with expected deliverables and deadlines. This list will condition the tech stack software engineers and solution architects must implement the outlined project plan.

Step 5. Team composition

The smallest team you will need for an employee-level enterprise app consists of a project manager, a software developer, a UI/UX specialist, and a QA engineer. In case the scope of the project is greater, this crew will have to be augmented. The same is true if you want to implement some features requiring specific expertise.

Step 6. Wireframe

This is a prototype of the final product to ensure the general direction you are following is correct. It presents UI elements and topography as well as the color scheme, size, and spacing of elements.

Step 7. UI and UX

It is here that the enterprise app takes visual shape. All elements are tested for their user-friendliness, and general appeal since UX is vital for the app’s success or failure.

Step 8. Coding

This pivotal phase of enterprise app development takes the longest to accomplish. During this stage, all functionalities are created, integrations are implemented, and dependencies are considered.

Step 9. Testing

Once you have a finished product on your desktop, ensure it functions as expected. QA specialists conduct various tests: unit, systems integration, user acceptance, etc. Each of those is carried out in manual and automated mode.

Step 10. Support and maintenance

Even if the app operates perfectly, a first-rate software vendor doesn’t rest on its oars. Here at DICEUS, we stay with our customers after the app is released as long as it takes to collect user feedback, introduce fixes, and provide post-launch maintenance to ensure comfortable UX.

While going through these steps, bear in mind possible pitfalls that can hamstring the successful implementation of the enterprise app.

Learn more about our enterprise software development company.

Business mobile app development challenges

The process of building enterprise applications has some pitfalls to avoid that should be forestalled at the planning stage.

Challenge 1. Shifting business requirements

The modern business environment is extremely volatile. Trends that seemed the last word in technology only yesterday become obsolete almost overnight and are ousted by fresh developments that robustly push their way in. Naturally, we can’t predict what the future has in store but can make technological allowances for such contingencies while mapping out the enterprise app. Anticipating possible changes in the industry, enterprise app developers should prioritize their product’s flexibility and scalability.

Challenge 2. Ensuring ROI

All business owners expect the quickest return on investment while “mobilizing” their company, but this process may last for ages for some of them. To avoid its stretching indefinitely, you must determine your principal KPIs that go hand in hand with your business objectives. These should become the benchmark metrics to gauge the efficiency of the enterprise app you are going to build.

Challenge 3. Engaging employees

Even if your enterprise app is a first-rate product that functions seamlessly and meets all business goals, it may fail unless you remember that your personnel will use it daily. So, however important the two previous considerations are, you should start creating a mobile app for your business not with business or technological aspects but with people.

What workflow activities can you delegate to the app? How will employees benefit from employing it? How would the implementation of the app impact their working routine? What are the categories of workers whose responsibilities will undergo the greatest changeover? Answering these questions is mission-critical in shaping your app implementation strategy and then pitching the enterprise app to your employees. Only their genuine engagement can turn this daring undertaking into a smashing success.

Once you have dealt with these bottlenecks, you should consider the technical side of the future enterprise mobile app project.

Enterprise app: Features and technologies

Having rendered customized services to enterprises based on specific needs for over a decade and a plethora of successfully completed software products in our portfolio, we at DICEUS know well what functionalities and characteristics a first-class enterprise mobile app should have and what know-how must be leveraged to implement them.

Multiple platform availability

You would like your enterprise app to perform smoothly on devices fueled by any operating system. Of course, absolute universality is hardly attainable but at least major platforms (such as Android, iOS, Windows, and Linux) should be encompassed.

Awesome user experience

Since employees of different ages and qualification levels will use the enterprise app, it is important that operating it should be foolproof to the utmost. That is why intuitive and highly responsive UI with a single design for all screen sizes is a must-have. Such simplicity will reduce the training time needed to learn how to use it, to boot.

Fast updates

Whatever improvements are introduced to the initial version of the app, they should be downloaded instantly, automatically, and simultaneously on all gadgets where the app is installed without annoying users or turning updating into a poser.

Broad integration potential

In the deeply digitalized world of the 21st century, every company with big-time aspirations is sure to have an internal IT environment of some kind (typically, ERP or CRM) that is employed to handle all mundane affairs. The future app’s API must be flexible enough to enable the integration of third-party resources (like social networks) or other software and tools that the management might decide to onboard later.

Real-time data management and analytics

Employees working with the app must have access to critical workflow parameters in real-time and be able to leverage analytic tools. These will provide valuable insights both into the efficiency of routine operations and patterns of customer behavior, enabling more knowledgeable decision-making.

Push notifications

Sending timely messages to remind of important oncoming events or update the staff on the latest in-house developments is second-to-none means of maintaining permanent contact with the personnel and constantly keeping them in the know of all activities pertinent to their set of responsibilities.

Offline mode

This is a vital feature for organizations whose branches are located in places with intermittent or no internet connections. Such extreme (for our computerized age) conditions shouldn’t become a halter on the efficient operation of the company. Offline mode availability of bread-and-butter shopfloor activities must keep it rolling no matter what.

Wide automation capabilities

What can be automated should be automated. People created machines to do boring or simple tasks which don’t require the intervention of the human brain.

Cloud storage employment

Today, legacy on-premises databanks are cumbersome dinosaurs as nearly all forward-thinking businesses move to the cloud. That is why a cutting-edge enterprise app must draw upon cloud-based data available 24/7 to all stakeholders wherever they are. The only thing for app developers to remember is to select the most effective deployment model.

Top-notch security

The security-first approach in mobile app development for enterprises should be the primary one, especially since such apps have multiple touchpoints through which cybercriminals can try to penetrate the system. Neglecting or underestimating these threats may lead to the loss or burglary of valuable or vulnerable data and considerable financial and reputational damages that will take much time and effort to repair. So, app developers should see that the product complies with the latest security standards and regulations, guarantees secure log-ins, blocks jailbroken devices, has at least two-factor user authentication, and encrypts all communication.

Robust app management and support

Authorized enterprise mobile app users should be able to allow access for onboarded staff members as well as track the app’s performance. If something goes wrong with the software or there are questions requiring an immediate answer, the support staff should apply for help through a support channel.

Utilizing AI and ML

Artificial intelligence and machine learning know-how is all the rage nowadays, getting significant traction in all IT-powered realms. It can reinforce the enterprise app’s functionalities (especially automation tools and security mechanisms such as face and voice recognition/authorization) and make the software more sophisticated in its operations, enabling chatbots and other state-of-the-art novelties.

IoT involvement

The Internet of Things is another cutting-edge technology that is making its decisive advent into many industries. When an enterprise app becomes a part of the IoT infrastructure, it will empower mobile devices to exchange data with other gadgets within the ecosystem, making human intervention unnecessary.

As you see, the roster of characteristics and technologies to include in the enterprise mobile app is quite extensive. Their presence is largely conditioned by the app’s scope.

Enterprise mobile app types scrutinized

According to the user audience, mobile enterprise apps are divided into three types.

- Employee-level apps. These solutions are basic and contain a shortlist of features. Typically, their functions are also limited, like messaging to facilitate communication between the team leader and its members and get both parties updated on the progress of work.

- Department-level apps serve the whole department and promote all business processes within it. As a rule, they contain more features than the previous type and are honed to fit the workflow routine of people engaged in a certain kind of work.

- Company-level apps. Such app solutions connect employees and managers across departments and create an internal network. This app type should encompass many functionalities enabling document handling, communication support, data analytics, etc.

According to their needs, companies opt for a certain app type to bolster their workflow.

Top B2B apps that rule the business world

The following apps examples are widely popular among modern businesses.

- Flipboard. This free product is indispensable for B2B business owners who struggle with keeping up-to-date with all the latest developments in their field. It peruses e-papers, social networks, and blogs to display them to the eager user in a magazine-shape format. All the user has to do is subscribe to relevant topics. They will never miss anything of a moment in our information-rich world.

- Dropbox. This free solution bridges the gap between the desktop and the smartphone. Being always on the run, B2B entrepreneurs can have 24/7 access to their documents, presentations, and spreadsheets.

- DocuSign. With this free app, signing receipts and contracts wherever you are is a cakewalk. Just upload there a scanned document and apply your signature digitally from your smartphone.

- Salesforce Mobile. We are all used to CRMs as exclusively desktop solutions. This free app allows B2B employees to access the system via the smartphone without compromising any functionality.

- WebEx. Meetings are an essential element of B2B nitty-gritty, and missing one can harm the reputation and revenues of your organization. WebEx allows you to never miss any of them and host them as well as organize various online events. This free app remarkably streamlines such video conferencing and enables file sharing to boot.

If you have unique business app ideas and want to emulate the success of these breakthrough apps, keep your eyes skinned for the disruptive advancements.

Enterprise mobile app development trends to watch for in 2022

In the early third millennium, the pace of technical progress is so rapid that IT novelties which have appeared only recently are sure to make their powerful impact on enterprise mobile app development during the current year.

- Blockchain. This technology enabling data in separate units connected via cryptographic methods is a godsend for enhanced security measures. Why? If a cybercriminal tries to penetrate the database and retrieve or change some information, his or her malevolent activity will be spotted and prevented thanks to the distributed character of this know-how. Moreover, the specifics of blockchain make it a perfect fit for building cross-platform and decentralized mobile apps.

- 5G. Turning this standard into a globally accepted one is sure to render all mobile solutions more powerful and fast. For all state-of-the-art technologies leveraged by app developers (AI, ML, IoT, cloud computing, natural language processing), 5G will serve as a mighty propellant giving them the fresh impetus and opening new horizons for business mobile app development.

- Beacon. While being not that new, this technology may get a second wind when applied in retail business enterprise applications. Thanks to it, brands can boost the personalization level of mobile apps that would accompany consumers throughout their visit to the retail outlet. Alongside guiding people through the shop, a Beacon-fueled mobile app for business will furnish insights into consumer behavior and enable targeted marketing at its best.

All this is fine, but how much it will cost me, you may ask.

Related content:

“Enterprise software development guide”

Assessing the cost of an enterprise mobile app

It may be a surprise for you to learn that it is not the vendor but the customer who determines the price of any software piece. In fact, the customer choices can drive the cost up or bring it down. That is why if you expect to see here the exact or approximate sum you will have to splurge on an enterprise app, you will be disappointed. In any concrete case, price calculation is individual, taking into account many factors that influence it.

The first question you will have to answer is whether you will commission an app from your in-house IT department (if your organization has one) or hire an outsourcer. If it is the former, you won’t spend a single penny on this very solution. You will just continue paying salary to many guys who will do their job. But keeping a whole team of a dozen specialists on a permanent payroll is what many medium- and most small-size companies can’t afford. And for startups that are always functioning on short commons, such overhead is definitely out of the question. Then, our only alternative is outsourcing.

You should consider the following aspects to estimate the cost of an enterprise app developed by outsourcers.

Outsourcing models

The two most popular engagement schemes include the Fixed Price and the Time and Materials models. Each one has its own merits and demerits and fits better certain project types and cooperation modes. So before making a choice, understand which model suits you more.

Project scope

A company-level mobile application with numerous features, third-party integrations, and advanced security protocols will be more expensive than an employee-level product with basic functionalities.

Team composition

If the IT crew has half a dozen specialists on its roster you will save a lot compared to paying for the work of large teams. However, cutting down on the number of developers spells waiting longer to receive a finished product (see below). And if it is a large-scope project, the development process undertaken by a lean team will linger indefinitely. Thus, a wise tradeoff should be sought in this respect.

Duration of the project

The sooner you want to obtain the finished product, the more it will cost you. On the other hand, long-lasting endeavors are also likely to become ever more expensive as months go by. So, be careful to determine an optimal project duration during which the development team wouldn’t be overtaxed but wouldn’t twiddle fingers either, hoping to get paid for working longer than necessary.

Outsourcer’s hourly rates

These parameters depend on the region/country the outsourcer hails from. The highest rates are charged by IT companies based in North America and Western Europe (between $150 and $250 per hour). The outsourcing services in South America are cheaper (around $50). If you go for the lowest rates, Africa and South Asia with their $15-20 would be your choice. However, the quality of execution is of a low level. So, this option may turn out to be penny-wise but pound-foolish.

The best solution to the selection headache would be to look closer at Eastern Europe. IT companies from Ukraine, Poland, and Romania, with the extensive talent pool and expertise, can deliver a top-notch product at $25-50 an hour.

On balance, a simple enterprise app is likely to cost $20,000-$30,000, whereas a high-profile business solution can be ten times more expensive and even strike the astounding $500,000.

Summing it up

If your company wants to enter the major league of business, it can’t do without launching its enterprise app that would streamline routine workflow and boost your organization’s efficiency.

Contact us to obtain a high-end mobile app with impeccable design and smooth operation.

FAQ

What is enterprise mobile app development?

The term presupposes building a mobile application utilized by enterprises in their internal workflow. Such a solution drives business efficiency by streamlining and automating essential shopfloor processes and facilitating relationships with customers.

How much does it cost to build an enterprise mobile application?

The final sum depends on several factors, including the selected outsourcing model, the project scope and expected duration, the team roster, and hourly rates charged by the vendor. On balance, be ready to fork out anything between $20,000 and $500,000.

Is the security of an enterprise mobile app important?

Since many organizations encourage their personnel to employ their own mobile devices in the working routine, the safety of IT solutions they leverage may easily be compromised. That is why, while creating an enterprise app, developers should prioritize the security of their product and protect it from unauthorized intrusions.