Financial app development to get control over your budget

In the U.S. Bank study, researchers reveal that 82% of all business failures occur because of problems with cash flow management. CEOs and CFOs don’t pay enough attention to financial app development and financial aspects at all. Thus, they face disruptive issues. This is true for startups but large companies also can be destroyed. Just remember the Great Recession during which leading banks weren’t able to predict and overcome the market’s reaction.

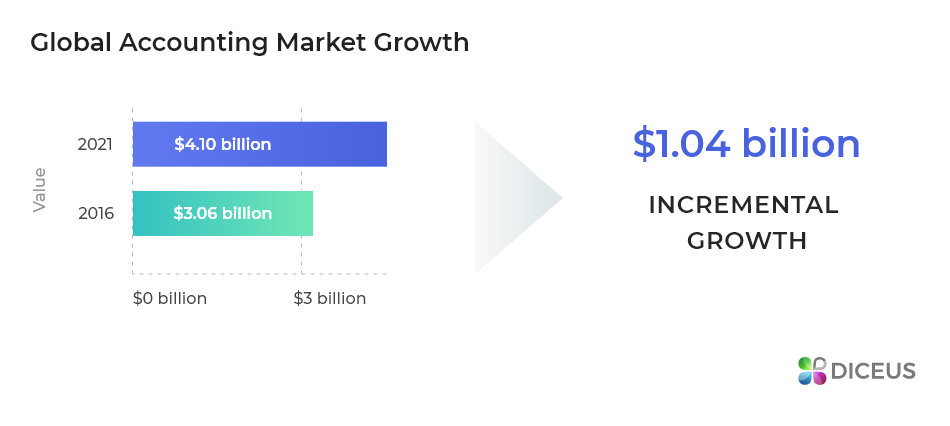

The first thing to enable proper financial management is an elaborate strategy. Still, the second one is hardware and software that bring this strategy to life. Fintech solutions are indispensable for nearly all businesses. SMEs can get a simple application to track money flow and avoid human errors related to payments. Simultaneously, multinational corporations benefit from all-in-one platforms with powerful analytical modules. This market grows constantly as analysts from Technavio predict that it will be valued at $4.1 billion by 2021.

The guide is to unveil key reasons to opt for fintech applications, main information about these technologies, and guidelines on choosing the best financial app builders.

Reasons to order a fintech app development

Let’s be honest: not all entrepreneurs need a dedicated financial app. Say, if you’re a sole proprietor, it’s not required to purchase costly software products. Excel and Google Sheets will handle the same functions with ease.

However, when you have a few employees and have to cooperate with several suppliers, subcontractors, and customers, financial app development is for you. Statista reports that access to finance may be a really tough task for numerous industries, including manufacturing, health care, social activities, retail, etc. With proper planning available through the software, it will be easier to avoid such problems.

Hence, let’s check the top reasons to get your own financial product:

- Existing apps can’t handle new tasks. If you have a system with limits on users or storage space, consider getting a new app for better scalability.

- Human errors are rising. The more complicated and global your company is the higher the chance of human errors. Get rid of them by automating finances.

- It takes longer to track finances. Update software when you realize that it’s inefficient when it comes to record keeping and money tracking.

- You can’t find the required info. Often, businesses have a tangled structure of data so employees just can’t access transactions, invoices, and user catalogs.

- You want to improve some areas. Good financial products provide real-time tracking, forecasting, and security boosts.

For businesses that require not an only financial improvement, we also have custom CRM development services.

Basic info about financial applications

In a nutshell, financial management covers all tasks and questions related to money flow in your company. It focuses on organizing and maintaining financial operations, including funds supply management, efficient usage of these funds, enabling investment opportunities, and so on. Three key areas of this sphere are based on planning, control, and decision-making.

Respectively, fintech app development focuses on designing and distributing of software solutions for financial managers and their departments. To understand the concept, let’s look at the types of applications, their functions, and dev steps.

Software types and fintech app developers

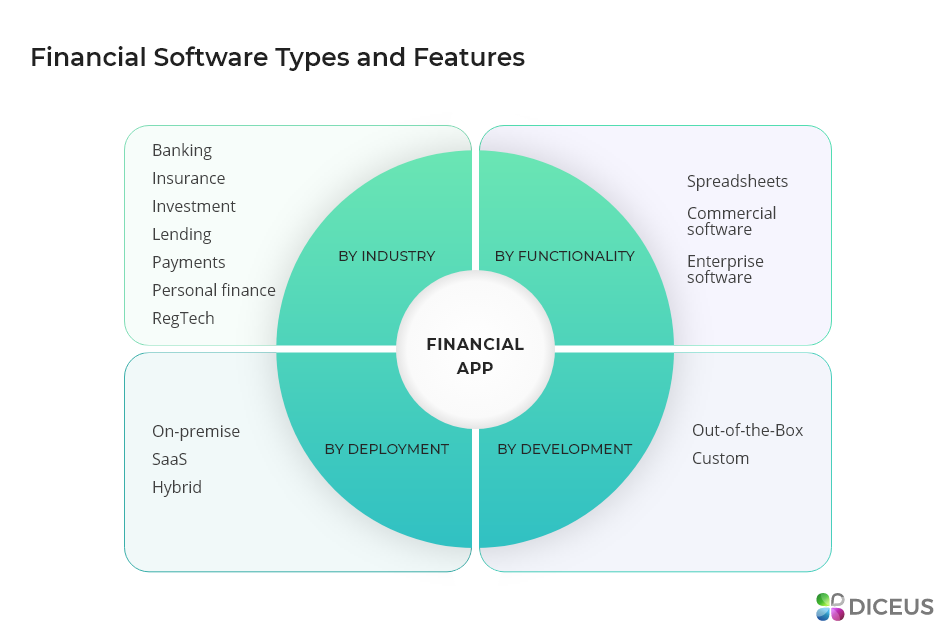

Fintech and accounting software isn’t the largest category overall. The catch is that it can be used in any industry and for any money-related tasks, so you can classify applications by several features. We want to discover three categories.

Note that fintech app developers may deliver various types of products. To find the best firm and get exactly what you need, consider working with custom teams. We will tell you more about them later.

Now, let’s talk about financial programs divided by different features.

Based on industry

As it was mentioned, fintech is suitable for all market sectors. From the smallest groceries in Texas to IT enterprises with offices all around the globe, every company requires proper planning of cash flow. However, there are a few perfect options to implement these apps:

- Banking.

- Insurance.

- Investment.

- Lending.

- Payments.

- Personal finance.

- RegTech.

Based on functionality

The next classification focuses on exact functions. There are three types of applications suitable for different organizations. For example, you may be interested in small programs or more complex alternatives. Here they are:

- Spreadsheets. The simplest and the cheapest solutions with minimum basic features.

- Commercial software. Focuses on midsized businesses and, partially, automation.

- Enterprise software. Delivers all-in-one services for the largest companies.

Based on deployment

Moving to tech stuff, we can’t skip the difference between distribution types. There are also three major categories so various businesses can find the most appropriate products. Look at the types and remember them if you’re going to contact fintech app developers:

- On-premise. According to this approach, firms that purchase apps must deploy them independently using in-house servers and specialists.

- SaaS. In this case, the developer deploys and maintains the software on behalf of customers. SaaS products may be located in clouds or on dev servers.

- Hybrid. These applications combine two options. For example, you can deploy the app on your server but cooperate with developers to maintain and upgrade systems.

Based on development

Finally, we should mention two defining options for customers. Check them out and choose wisely:

- Out-of-the-box. These programs are created once and then delivered to all clients. They feature the most efficient modules and structures but lack uniqueness. With premade software, you can’t get the best market advantage. Plus, these applications come with lower initial costs but higher further expenses on additional services.

- Custom. Here, financial app development is exclusive for each partner. You get a product made from scratch and unavailable for other customers. With bespoke software, users don’t have to overpay for unnecessary features so they receive only the required stuff. Custom programs can include all the extra services in the initial contract.

Functional modules

Applications that are more complex than simple spreadsheets often consist of different modules. Each part is responsible for a specific feature. Vendors of premade software sell fixed sets of these features while custom developers can add or remove any module at your request. Basically, all functions can be divided into four groups: pipeline tracking, asset management, fund management, and data processing.

Exact types are diverse so let’s check the most useful modules:

- Balance sheet. Lists the company’s assets, financing sources, money usage, and general state of cash flow. Is used for reports and analysis.

- Chart of accounts. Includes account of the firm. Identifies and tracks assets and also helps to collect info about financial processes.

- General ledger. The core of each system that keeps records and other data. Links other modules by receiving info, helps in audit, and creates documents.

- Payable. Gives insights on funds owed by a business to partners. Tracks funds with terms and conditions for each deal, generates invoices, and keeps clients’ info.

- Receivable. Works like the previous module but relates to money owed by partners to the firm. Creates bills, controls data, and handles payments.

- Sales. Monitors points of sales, automates regular transactions, helps to track down entries with info about customers and products/services purchased.

- Trial balance. Focuses on the real-time balance of each account. Allows to check changes and generate new financial statements.

Moreover, you can combine these finance-related functions with extra parts such as CRM or ERP platforms, reporting and visualizing modules, third-party integrations, etc.

Java, Python, and Ruby are the best programming languages for fintech app developers.

Development stages

As well, it’s an interesting thing how the core dev processes are going. We don’t want to dive in tech details too much because they’re pretty boring. But managers, CFOs, and users of financial apps should be aware of key development stages to understand how partners work. Further, you can check the main scheme of cooperation between our experts and our customers. Everything is personalized so we can adapt this strategy to your requirements:

- Business analysis. We research your company and the market to provide our vision on the best functions. Final cost estimations are available at this moment, too.

- Feature discussion. We agree on terms and conditions, as well as the demanded functions. Feel free to engage the company’s stakeholders and key employees.

- Legal agreement. We sign all the required contracts to regulate our cooperation. Usually, SRS documents are the result of this step.

- Agile development. We create your product in several sprints during which you can deliver feedback. We can release an MVP or the final version.

- Release of the product. We test and evaluate everything before the release. Overall, we strive for perfect time-to-market and high quality.

- Support and maintenance. We can cooperate in the post-launch phase, too. Depending on your requirements, we handle the training, customer support, upgrading, and so on.

Key benefits of custom solutions

Well, what about the real usefulness of the reviewed software? Financial app development can be a game changer for your company if you feel that accountants can hardly handle ongoing and planning processes. Modern digital platforms automate numerous tasks, provide valuable insights and predictions, help to improve the brand’s profitability, and more.

The list below includes the major advantages of fintech solutions. Still, you should remember that only the companies that really require a new financial app can get the most benefits:

- All the data at your fingertips. Gather all financial data in one place to get constant and quick access. Data silos are harmful so you want to get single storage for all departments and employees with enough access rights.

- Compliance with changing regulations. Elaborate software adheres to BASEL II and other regulative principles thanks to powerful auditing and reporting features. It also can evolve quickly to meet new requirements.

- Error-free environment. This part is simple. Various human errors occur because of fatigue, poor attention to details, and personal problems. Automated software is flawless if programmed properly so you can avoid double entries and missing records.

- Planning and growth measuring. When working with custom dev teams, you can ask for upgrades to make your application highly scalable. Moreover, it comes with solid analytical modules that enable efficient financial forecasting.

- Streamlined financial processes. Thanks to the single database and automation, accountants can speed up all the processes. In addition, they can develop common standards for all departments to boost data gathering and reporting.

- Third-party connections. If you work in an enterprise, consider this advantage related to internal and external links. ERP financial solutions connect all in-house apps using common protocols. They also work with external services.

Depending on your tasks, consider choosing dedicate Dot Net, PHP or other devs.

Choosing the best fintech development company

When it comes to cooperation, you will have several options. Firstly, remember that there are dozens of vendors that sell preprogrammed apps. They may be suitable for companies with traditional requirements. If you’re happy to find the package with an appropriate balance between fees and features, purchase it. Just don’t forget that all out-of-the-box apps come with a pretty high price on extra services.

Talking about custom financial app builders, you should be sure that the chosen team is capable to complete your project. Here are a few suggestions on the example of our company – DICEUS:

- Agree on dev tools. If you have a clear vision on programming languages and frameworks, be sure that the chosen team knows them properly.

- Check previous projects. You can find portfolio at Clutch or GoodFirms to understand the field of specialization. We love finance and insurance, for instance.

- Read client reviews. Testimonials are available at the mentioned sites, too. Explore them to reveal the attitude of other customers.

- Talk to managers. We’re ready to chat with you, talk via phone or meet personally. Consultations are free!

For banks and other financial firms, we provide skilled fintech developers.

FAQ

In this section, we reveal answers to the most popular questions related to the topic. Without further ado, let’s check them!

What is a financial app?

It’s a software solution that enhances and automated financial management. Apps can focus on different areas but often include key modules such as general ledger, payable, receivable, etc. Fintech products suit various industries and firms.

Who are financial app builders?

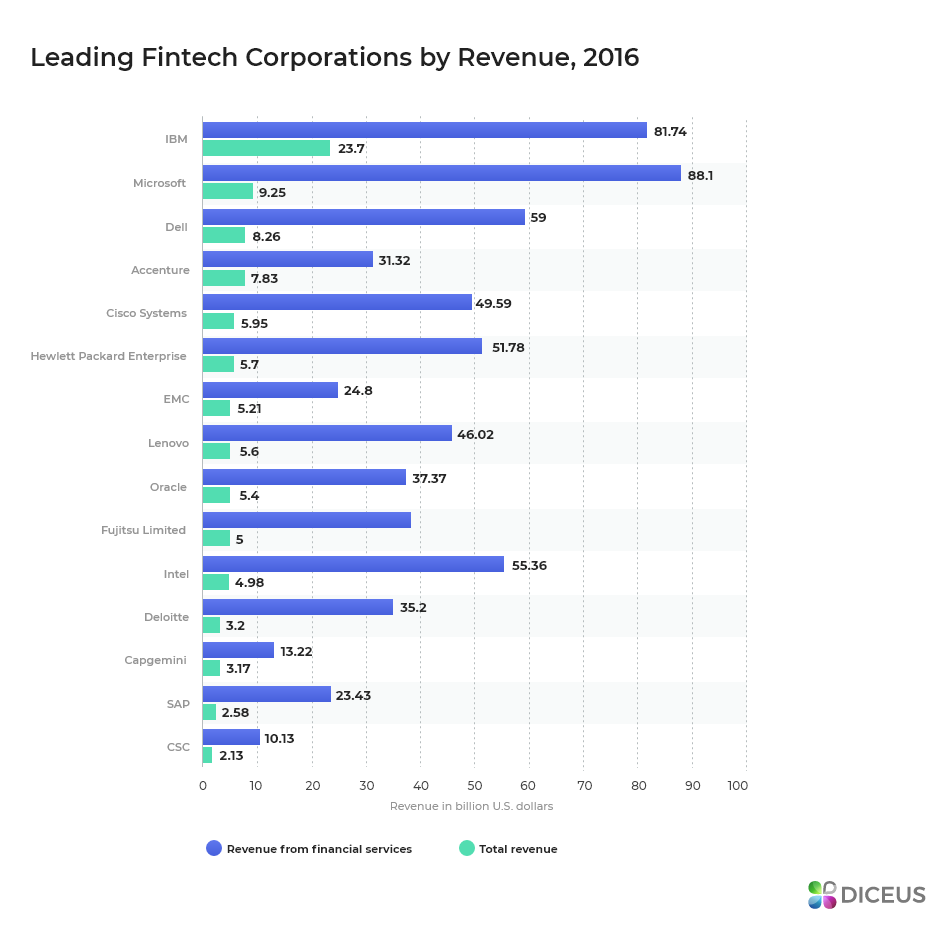

Fintech corporations are diverse as they consist of all-in-one IT firms and specialized startups. For example, IBM got $23.7 billion in 2016 from financial app development only. It’s more than a quarter from the entire annual revenue.

How to build a personal finance app?

Honestly, we suggest purchasing an application from dedicated developers. You can choose among out-of-the-box solutions and custom ones. Dev teams either deliver predefined sets of functions or create them from scratch.

Why is it better to choose a custom product?

Custom fintech programs are preferable because they can be tailored to your exact needs. Also, this software type provides for constant communication between partners, transparent costs, and long-term partnerships.

How to find a reliable dev company?

In a nutshell, we suggest conducting accurate research. List several companies, check their previous projects, and ensure that devs have enough skills for your tasks. It’s always better to talk with representatives personally, also.

Closing words

Financial app development is highly required for almost all brands. If you aren’t sure in its usefulness, exact features you need, dev approaches or other nuances, don’t hesitate to ask our experts. We provide free consultations to customers regardless of the project’s scope. Don’t wait and order your unique fintech solution today!