How to hire developers in Ukraine after February 24, 2022

This article is devoted to the actual situation in the Ukrainian IT market in 2022. Here you can read why it is worth outsourcing software development to this country, what the risks are and how vendors manage those. The information will be useful mainly for those who are going to hire software developers in Ukraine and have some doubts about it.

On February 24, Russia invaded Ukraine. War has taken and changed the lives of many people. No one could think that we would have to face war. No one could imagine we would have to adapt our professional activities to this reality. Obviously, most of Ukrainian businesses suffered. Farmers, energy companies, the metal industry, logistics, and many more niches suffered losses since the first days of the war. However, understanding the importance of business functioning, the majority of regions are trying to recover their pre-war operation.

The IT sector has appeared to be the most stable. Let’s take a closer look at the state of the IT sector today. Afterward, you can read about the risks of IT outsourcing in Ukraine and why it’s yet worth doing business here.

Check out our IT staff augmentation services.

The state of the IT sector in Ukraine as of 2022

The IT industry is considered to be one of the most solvent in Ukraine nowadays. Traditionally, IT companies pay taxes fully and on time. Even under martial law, these companies managed to pay their taxes on time. Some of them did that in advance.

Since the vast majority of software development companies had business continuity plans, they were able to react immediately on being informed about the start of the war. HR managers took an active part in organizing the relocation of their employees to safer locations in the country or overseas. As a result, a lot of developers could leave for the Western part of Ukraine, which is considered to be the safest. Some engineers moved to Poland, Germany, Romania, Spain, and other European countries.

Now, people both who relocated and who stayed at home continue working remotely. The most vivid reason for quite a quick transition to the new reality is the fact that IT workers had been working remotely for a long time because of the COVID-19 restrictions. They got used to WFH reality; that’s why they have demonstrated the same flexibility today.

Speaking about the location of companies that stayed in Ukraine, we have already mentioned that many left for the West of Ukraine. They organized their work in such cities as Lviv, Ivano-Frankivsk, Chernivtsi, Uzhhorod, etc.

At the end of March, a leading platform for Ukrainian developers Dou surveyed around 7,000 IT specialists and asked how their lives changed with the beginning of the war. According to the survey’s findings, almost 60% of respondents left their homes. More frequently, these people moved to the following cities:

- Lviv Oblast – 11%

- Zakarpattia Oblast – 9%

- Ivano-Frankivsk Oblast – 6%

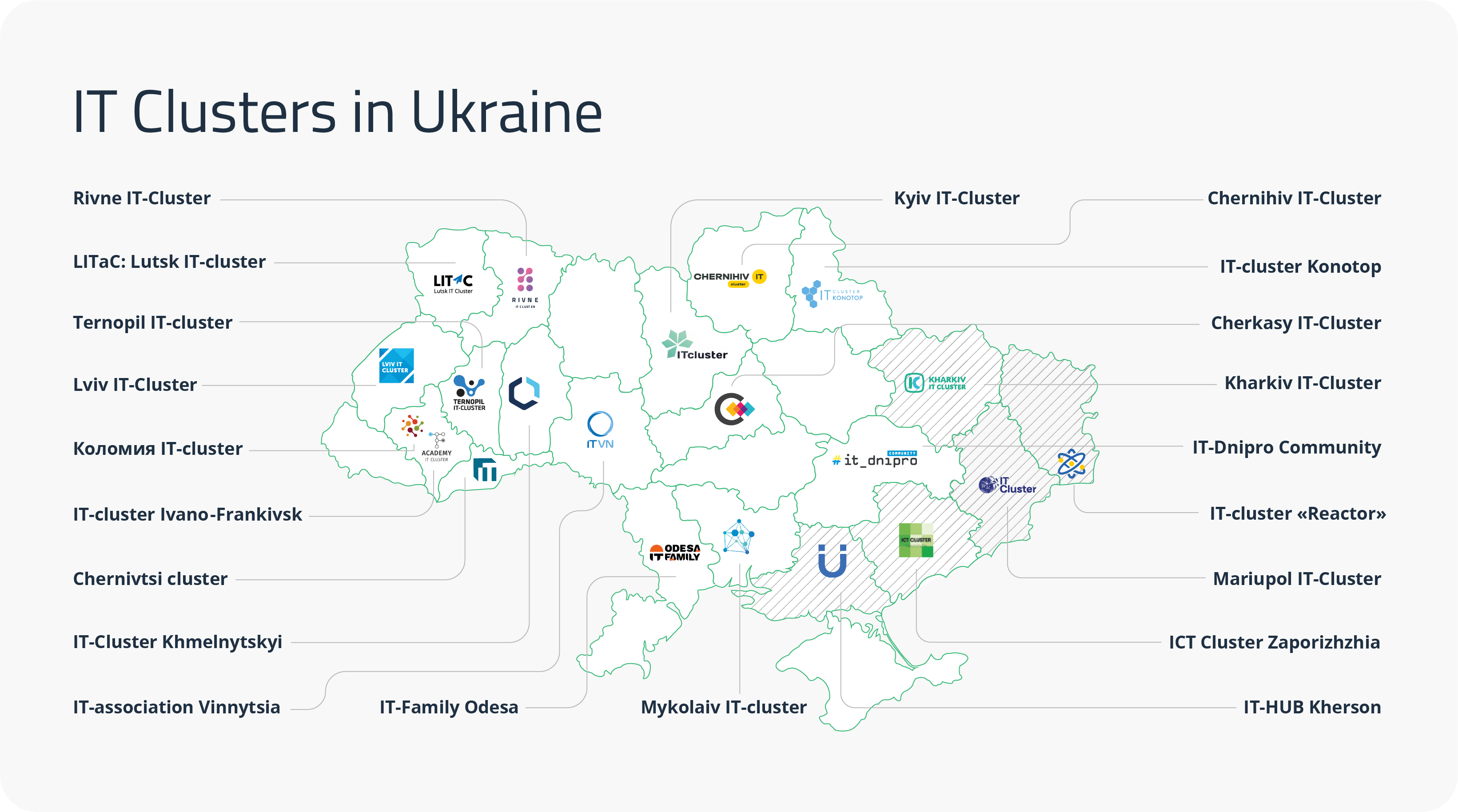

Below you can see a map of the main IT clusters located in Ukraine as of the beginning of 2022. Hatched are the areas of military operations. These are mainly in the Eastern and Southern regions of Ukraine.

Source: https://dou.ua/lenta/articles/it-clusters-from-war-zones/

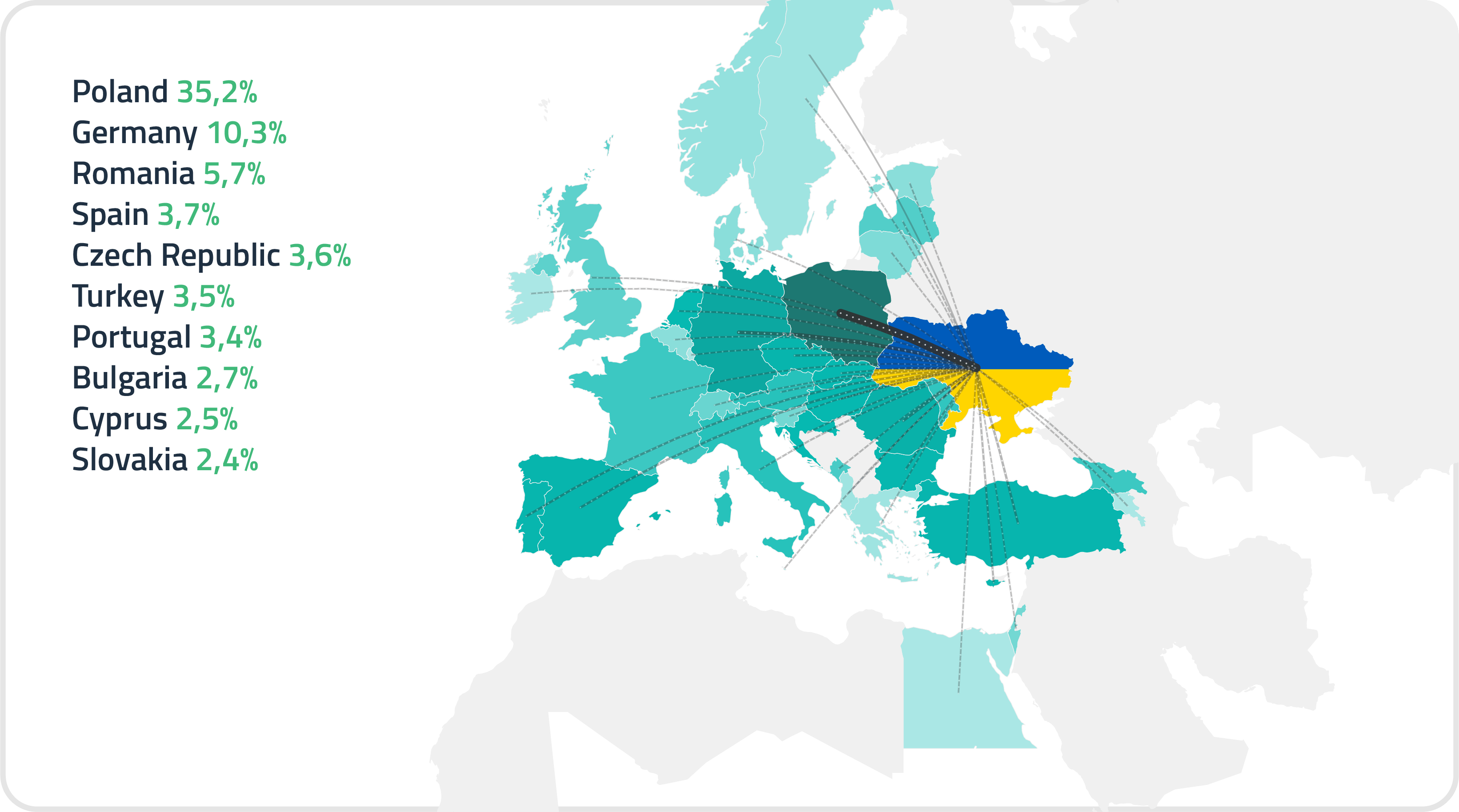

Talking about the places where Ukrainian developers moved to, we can say that the ten most popular directions were Poland, Germany, Romania, Spain, the Czech Republic, Turkey, Portugal, Bulgaria, Cyprus, and Slovakia.

Source: Dou

The most important criteria IT specialists considered while relocating both inside and outside the country were safety and the possibility to stay at their relatives’ or friends’ places.

Sometimes, the choice of the country to relocate to depends on the fact whether the company had some offices in other countries. So, those companies that had such offices could help their employees relocate fast and hassle-free.

Ukraine 2022: Are there any risks when you hire developers?

Before the war, many clients worldwide wanted to hire Ukrainian developers because they found them to be highly skilled and reliable. Other reasons were convenient time zone, the flexibility of cooperation, rates lower than in other European countries. The current situation has changed the attitudes among potential customers. Some of them prefer looking for hiring developers in other countries than Ukraine. That is mainly because of their concerns about the safety of doing business with Ukrainian companies in the background of war.

Executive Director at IT Ukraine Association Konstantin Vasyuk says that there are three factors that could affect the effectiveness of IT specialists negatively. They include gradual economic slowdown, potential limitations of access to the Internet because of damage to telecommunication networks or energy supply, and military mobilization. Let’s take a closer look at the key risks of outsourcing in Ukraine and see how the sector manages those.

Risk 1 — Disruptions in work

Obviously, a lot of people, who are going to hire Ukrainian developers, think of all the potential risks of this affair. Disruptions in work and communication between customers and teams can arise because of any damage to telecommunication and energy supply networks. The same goes for problems with access to the Internet or security breaches like DDoS attacks, etc. However, all these risks are properly managed by the IT sector.

First off, a larger number of software development firms have suspended the work of their offices in the regions that have suffered or are currently suffering from military operations. As we mentioned above, they moved to safer areas. However, even those who stay in relatively safe cities have stable access to the Internet. As of 2019, 70% of the territory of Ukraine was covered by the Internet.

Risk 2 — Possible changes in team composition

Team composition is discussed and agreed on at the first stage of the project, which is usually called a discovery phase or business analysis. Based on the outcomes of that phase, the vendor’s team recommends the client a certain number of software developers, test engineers, designers, and other tech staff. These people will do all the jobs related solely to your project. Most clients are afraid that due to military mobilization, some of their team members can be conscripted for military service.

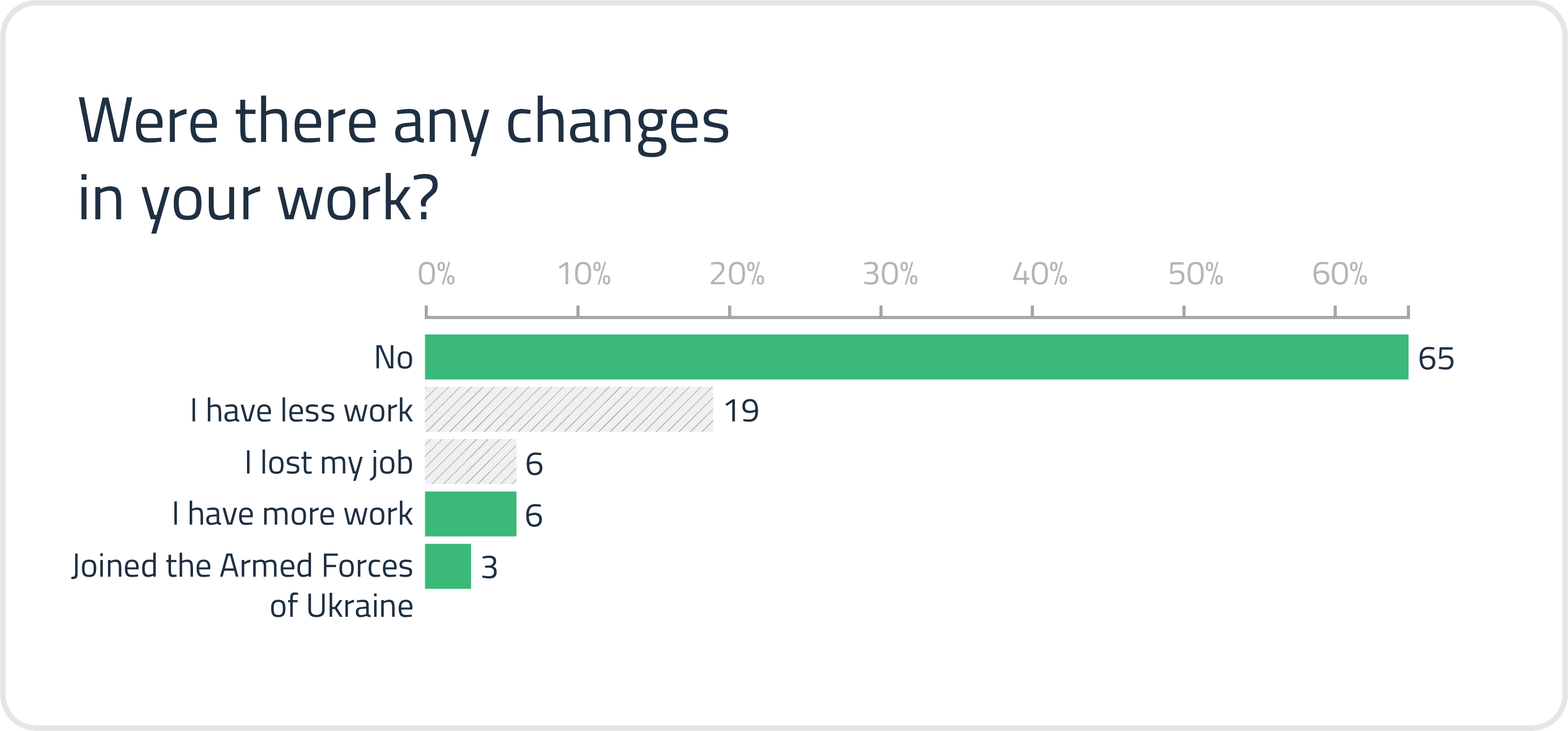

Such a scenario is hardly possible. Firstly, according to the survey from Dou, only 3% of 7,000 respondents decided to join the Armed Forces and volunteer battalions, as you can see in the picture below.

Recently, Minister of Digital Transformation Mikhail Fedorov offered to limit the mobilization of IT industry representatives. Besides, mobilization in Ukraine is divided into several waves:

- The first wave includes former servicemen under the age of 40 who have the latest combat experience.

- The second wave is servicemen who served until the last wave of mobilization.

- The third wave of conscription is related to conscripts who graduated from military departments of universities as reserve officers and were not called up during the previous waves of mobilization.

- The fourth wave includes all other citizens who do not have age and physical restrictions on conscription and can be involved in the recruitment of the Armed Forces and other military formations.

The last wave will enter into force in a worst-case scenario of full-scale war.

Risk 3 — Violated deadlines

One more fear is deadlines. All customers want to get their software projects done on time and within scope. At peaceful times, on-time delivery was fully guaranteed by vendors. Slight deviations from the project timeframe occurred mainly because of change requests from the customers’ side.

Despite the facts mentioned in the foregoing paragraphs, IT companies keep guaranteeing on-time delivery. That’s possible because business continuity plans were implemented immediately after the start of the war. It’s no secret that such plans were traditionally prepared and implemented by Ukrainian software companies if necessary. Usually, such plans are composed solely for a particular company by its experts. However, as a rule, the points of today’s BCPs are quite similar:

- Relocation of company’s staff to safe locations

- Support for employees who stayed

- Ensuring the security of projects and data backup

- Cooperation with colleagues from other IT agencies

- Payment security and tax regulations

- Support of the Armed Forces of Ukraine

- Other

By the way, the volume of deals didn’t change. Moreover, some clients expressed their interest in expanding cooperation. Together with Delivery Managers, Project Managers, and Product Managers, they were able to discuss and see new opportunities in existing projects.

Reasons for outsourcing: Why hire software developers in Ukraine?

Are you considering Ukraine IT outsourcing? Here are some key reasons why your choice is right:

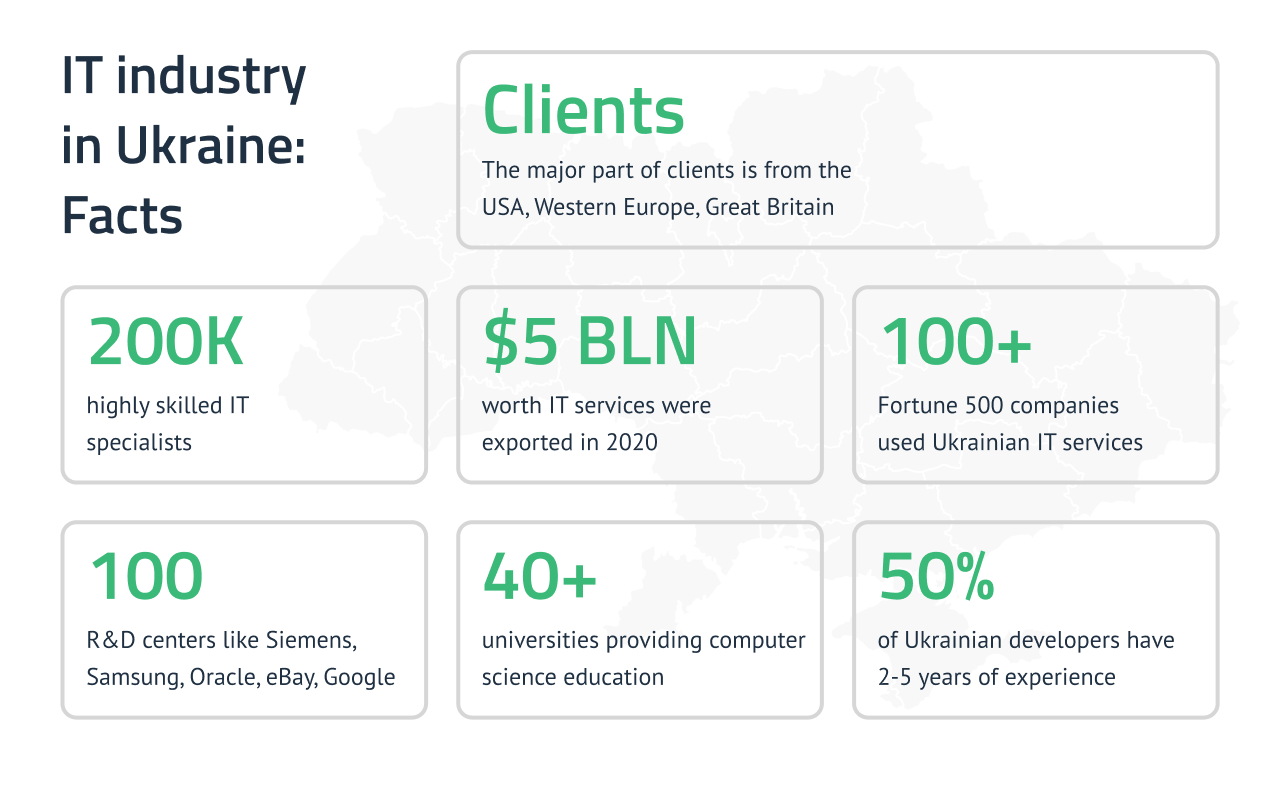

- Ukraine has more than 200,000 highly skilled specialists working in the IT industry.

- IT services exported from Ukraine in 2020 equal to more than $5 billion.

- More than 100 Fortune 500 companies used Ukrainian IT services.

- There are around 100 R&D centers that represent or partner with such companies as Siemens, Samsung, Oracle, eBay, Google, and many more.

- The major part of Ukrainian clients is from the USA, Western Europe, and Great Britain.

- Ukraine has around 40 universities providing computer science education.

- 50% of Ukrainian developers have 2-5 years of experience on average.

As you can see, the Ukrainian IT industry is quite fast-growing. It is a good fit for those who search for a good quality-price balance. Let’s take a closer look at the services, expertise, and prices of IT firms in Ukraine.

The services Ukrainian IT companies offer

90% of services provided by the Ukrainian IT companies are delivered to various countries of the world. The most popular services include custom software development, including web and mobile app development, system integration services, cloud solutions, legacy system modernization, and many more. Here is a comprehensive list of services you can get.

End-to-end development is traditionally popular within enterprises that need a dedicated team to solve their IT challenges. For example, a bank hires a software vendor to upgrade a core banking system.

Another popular service we mentioned is IT staff augmentation — hiring developers to scale up your project team. Many technology companies and startups developing software products often lack skills, expertise, and resources due to a wide range of reasons. So, for quick scale-up, they prefer augmenting expert IT staff to hiring people in-house.

So, if you need any IT service, be sure that Ukraine will meet you with hundreds of perfect opportunities to find the provider you can trust.

What level of expertise can I find here in Ukraine?

Any customer contacting us for the first time told us why they decided to hire a Ukrainian developer for startups. Some of them were frustrated by their previous experience in outsourcing to other countries. The others were recommended to search for developers in Ukraine because of the high level of their engineering expertise and excellent team extension services.

We can talk about expertise endlessly. It’s not solely about skills and knowledge. It’s about the willingness to help and solve your challenges together. Here at DICEUS, 100% of software engineers thoroughly explore the client’s business logic before the development.

With the help of business analysts and architects, the rest of the team must completely understand how the client’s business or solution works, what business and technical challenges they have, and how a final solution should function to meet the requirements.

Besides, expertise is also about the engineering background in a particular industry. For example, you may find a developer who’s super skilled in creating a payment gateway for retail but knows nothing about RPA solutions for banking. Although that’s not a problem, you’d likely prefer choosing an engineer with experience in projects similar to yours.

The strongest sides of Ukrainian IT specialists

Each year the number of Ukrainian IT specialists with a Master’s Degree in computer science is increasing — around 20,000 young people graduate from universities yearly. Most of these students start working in the third or fourth year of study, which gives them a head start in their career path.

Due to a great passion for technology innovations, Ukrainian developers are interested in advanced technologies and regularly improve their knowledge of artificial intelligence, blockchain, robotic process automation, big data, etc.

Ukrainians are good-natured and easy-going; that’s why any foreign customer can find common ground with a Ukrainian engineer. Most IT specialists speak English fluently as lots of software companies ensure free English classes for their employees. Thanks to regular classes with professional English teachers and communication with native speakers, IT guys have a good command of spoken and written English.

Ukrainian developers are flexible. There’s no problem organizing flexible working hours or even days if the client has another time zone and somehow needs to shift a working schedule. Besides, you can agree on many other things before starting the project: engagement models, metrics, deliverables, acceptance criteria, and many more.

Level of service

The level of service in Ukrainian software development companies is rather high. It usually depends on the company’s corporate culture and work ethics. Here are the essentials to pay attention to when choosing a software vendor:

- How well is the pre-sales process organized?

- How valuable are the vendor’s recommendations?

- Is the vendor consistent in communication?

- How soon did you get the proposal?

- Do you get regular project updates?

- Do you get on-time answers to your questions?

- Are the deadlines met?

- And many more

The level of service is a combination of expertise, quality, communication, and empathy. You should feel comfortable with your vendor, like you were talking with your friend, drinking a cup of coffee.

Good read:

How to choose a reliable software vendor

Project management methodology

If you hire developers in Ukraine, you can rest assured that your project will be appropriately managed by a professional project manager. For example, here at DICEUS, some of our project managers have IPMA certificates.

As for the methodology, Agile and Waterfall are the most popular methodologies to manage a project. However, this can be discussed if a client has different requirements. Task management is usually performed via Jira, and in some cases, customers are provided access to the project’s board and reports to track the progress. It’s pretty comfortable for a client to see how much time is spent on the task, what dependencies the task has, who is responsible, etc.

Costs to hire software developers in Ukraine

No company will tell the exact cost of software development, be it Ukraine or another country in the world. Usually, the cost of software development in Ukraine depends, but is not limited to, much on the following factors:

- The complexity and scope of your project

- The chosen technology and platforms

- Number and seniority level of team members

- The urgency of time to market

How to get an accurate estimation of the project cost? First off, you should gather all the information about the project goal, requirements, and budget. However, if you feel stressed gathering the requirements, don’t worry — a software vendor will offer you to undergo a business analysis phase, also called a discovery phase.

The discovery phase is a time you spend together with your vendor formalizing all requirements for your software product. That’s a guarantee of getting the most accurate, non-ambiguous specifications to ensure smooth design, development, testing, etc. Moreover, it’s a guarantee of getting what you expect.

So, what about the costs? Although your vendor only can name the exact budget you need to spare, we conducted short research on software engineer salaries (per month) in Ukraine.

- Junior software engineer – $300-1000

- Software engineer – $2300-3350

- Senior software engineer – $3650-5000

- Team/tech lead – $4250-5800

- System architect – $5250-7500

As you can see, the salaries are at least twice as low as in the US, for instance.

How to hire developers in Ukraine?

Apart from IT outsourcing to Ukraine, many companies search for IT staff services, also referred to as IT outstaffing services or IT staff augmentation. In most cases, the consumers of this service are fast-growing technology companies requiring quick scale-up, specific expertise, or developer skills.

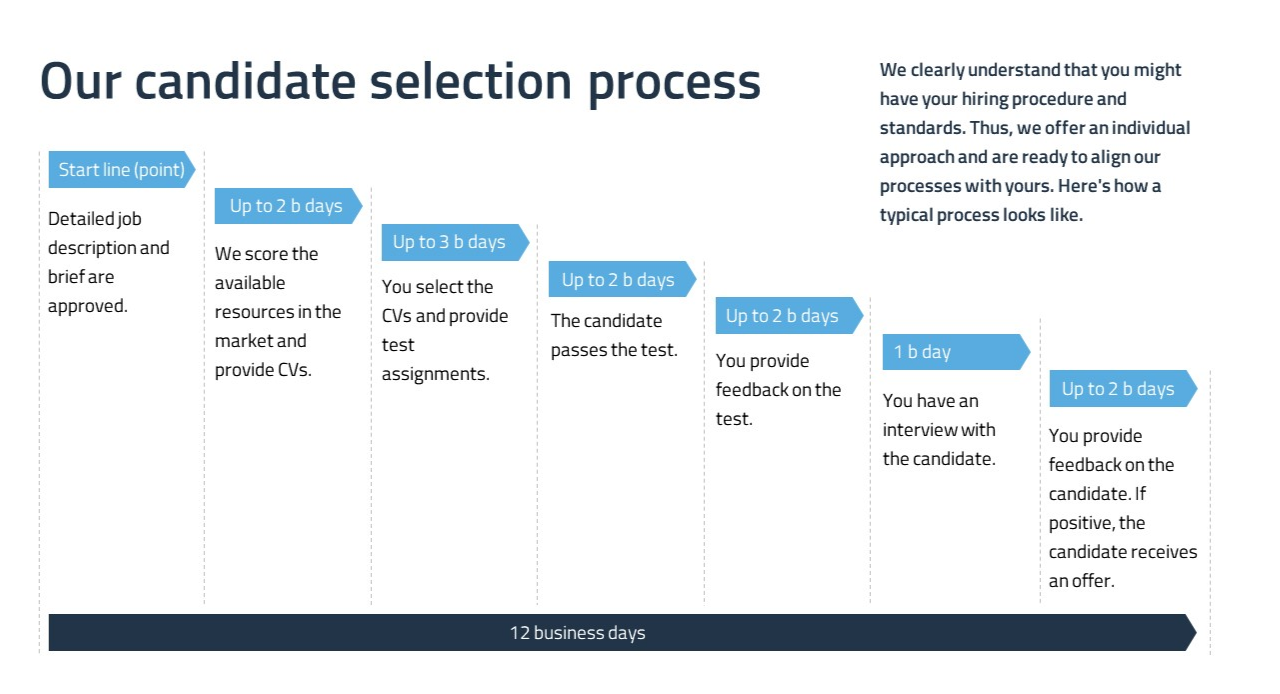

The time needed to select suitable candidates for the client’s project differs from vendor to vendor. For example, here at DICEUS, for example, it takes us from 12 to 21 business days to offer you the right people. Our process is well-organized and includes all essential stages of staff augmenting: job description creation, candidate sourcing, recruiting, hiring, and onboarding.

Usually, we have more than 250 developers available to start working immediately or in a short time and many IT specialists in our talent pipeline. Also, if you need more than developers with specific skills but a whole team, we offer dedicated teams for your particular project.

Hire developers quickly: IT staff augmentation service for you

Summary: How to find a reliable software vendor?

Are you stuck looking for the right software company? Googling over the Internet and finding endless lists of software companies in Ukraine won’t help if you don’t get how to distinguish a reliable vendor from scams. The knowledge and skills for effective software vendor search should include the following:

- Where to search for software vendors

- How to shortlist software companies

- What things to discover with a potential vendor

- How a good proposal looks like

- Criteria to evaluate when choosing a vendor

- How to select the suitable engagement model for you

- Ways to check if your vendor is cheating

- How to control the project after you signed the contract

- How to collaborate with a vendor effectively

You might think that that’s too much to know but believe, that’s a minimum you must know if you want to hire the right company. So, to cut a long story short, we gathered all these tips into one helpful white paper, which can be downloaded here.

The state of work in DICEUS

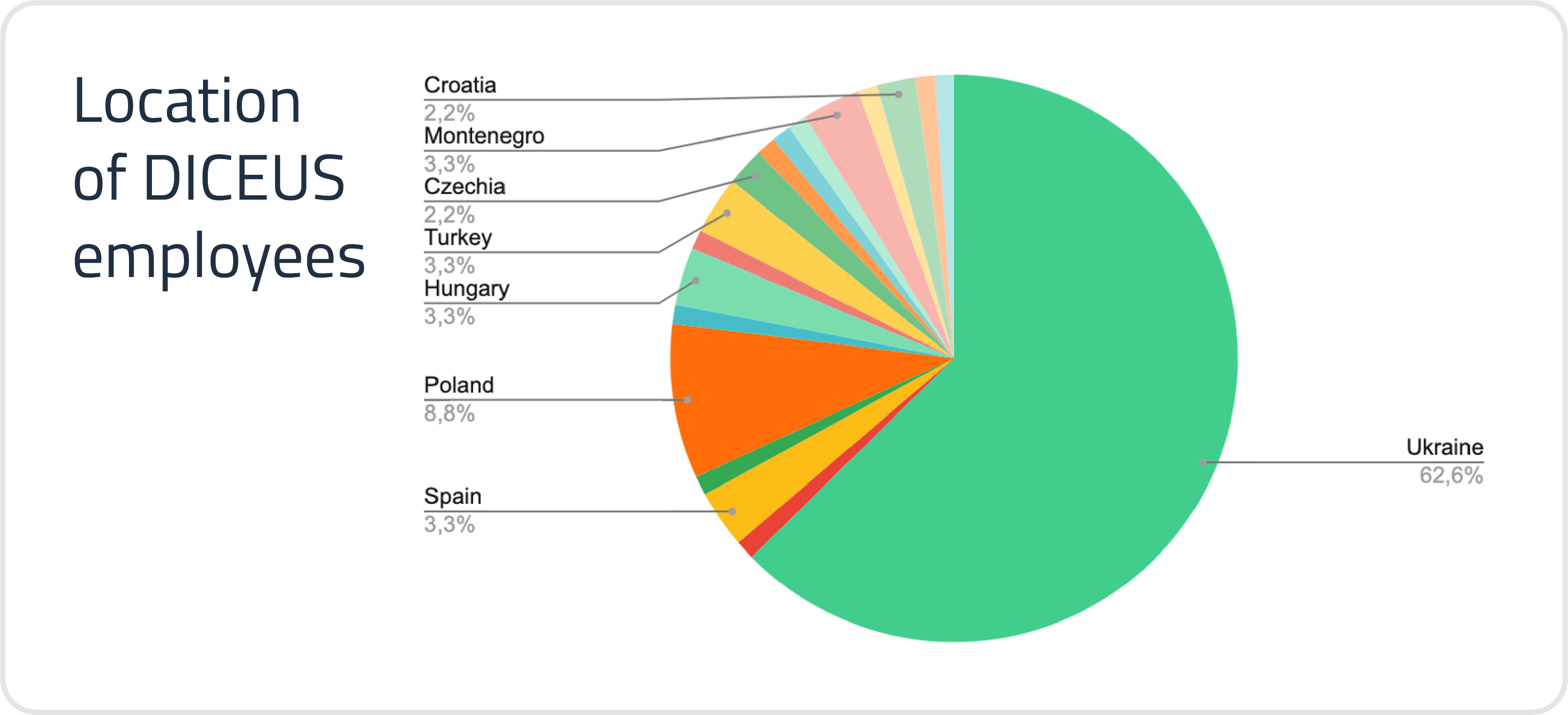

Like many of our colleagues, our team had a business continuity plan. The company’s first priority was to help employees relocate to safe locations. Our HR managers did their best to help team members move to the Western part of Ukraine. They kept in touch with those who needed support and coordinated the relocation. As of the beginning of April 2022, 62,6% of our employees stay in Ukraine, the rest are in the countries you can see in the picture below.

Speaking about the operations, DICEUS is opening a Delivery Center in Wroclaw, Poland soon. The Administrative Center is located in Vienna, Austria now. These two locations in Europe allow us for the following:

- Ensure smooth recruiting of developers that are located in Europe, both Ukrainians and Europeans.

- Support the existing process of recruiting for those clients who wish to hire developers in Ukraine.

- Maintain all negotiations with our clients in Europe (face-to-face meetings, online meetings, calls, free consultations, demos, etc.).

- Ensure continuous delivery of projects and absolute security guarantee of doing business with DICEUS.

As for our current state of cooperation, we keep working on all projects. Our clients have supported us greatly during the first days of the war. Together, we did much to seize new opportunities in the existing software development projects.

How we can help you

DICEUS has been developing custom software since 2011. Our team offers two main services, which are custom engineering and IT staffing. The first one includes around 40 particular services like web and mobile app development, enterprise software development, data migration, cloud computing, and many more. The second one is a service that helps technology companies hire remote developers.

Learn more about DICEUS.

Speaking about bespoke software, we can build a software solution using our profound expertise in BI, AI, ML, cloud computing, RPA, blockchain, IoT, etc. Our clients are located around the globe, functioning in various industries like banking, insurance, and healthcare, to name a few.

Our approach to business operations is well organized. So is our SDLC. Any project starts with a discovery phase, which ensures the project’s successful outcomes.

Thus, if you are going to develop a software product, please read more about the discovery phase.

If you are going to hire developers in Ukraine, please visit the “IT staff augmentation” offering.

How you can help us

“How can we help you?” was the question we got from our customers during the first month of the war. We replied, “Give us more work”. That was the short reply clear to all who stand with Ukraine. As you could read above, our clients expanded their cooperation with our company. That helps us support our country, the Armed Forces of Ukraine, and our families. From our side, we did our best to find out how and which new values we could bring to our customers.

Therefore, if you are looking for highly skilled engineers, hire software developers in Ukraine. From our side, we guarantee high-level expertise, professional project management, and high-quality outcomes.

To get a free consultation, send your request.

Stand with Ukraine: Since February 24, 2022, our company donates to the Army of Ukraine and special funds. You can also do this by donating to the “Come Back Alive” fund, the biggest organization providing support to the Armed Forces of Ukraine since 2014.

FAQ

How to hire remote developers?

Work from home has become an integral part of the new work culture. Businesses have already got used to hiring remote employees. And the IT industry was probably the first and the most successful sector to adapt to the new recruiting rules. There are many ways to hire remote developers. Firstly, you can browse through special websites for freelancers. Secondly, if you need more expert developers, you should pay attention to more professional listings like Clutch. Thirdly, you can contact a recruiting agency that specializes in IT staffing.

What are software development rates in Ukraine?

Development rates in Ukraine vary from $30 to $150 per hour. The cost depends on the following factors: the seniority level of a developer, their expertise, and experience. The scope of the project, tech stack chosen, and team composition also impacts the estimation. If you would like to get an accurate cost estimation, prepare to start your project with a Discovery Phase. Only then can a vendor calculate the overall cost close to the real sum.

What should you know before hiring an IT vendor?

Before cooperating with any IT vendor, you must be prepared to answer the questions related to your project. The most frequent questions are related to the requirements, project and business-wise goals, your budget, stakeholders, etc. Thus, be ready to provide any available documentation you have, e.g., a project roadmap, mock-ups, examples of similar products, and high-level requirements. However, if you don’t have this information, it’s not a problem. Professional vendors will help you define your goals, priorities, and values you can get as the project outcomes.